So the way it goes, from what we’ve understood, is that you go to college so you can get a good job. But you can’t go to college without debt, so you spend the first decade of your “good job” paying for college. Somewhere in there you get married, buy a house and have kids. The order of which seems to be flexible these days. The debt, though, that’s unavoidable.

All that makes for a fun and challenging decade. Weddings are fun. Kids are fun. Debt is inevitable, and a house will eventually become a necessity – and besides, everyone knows it’s a “good investment.”

What happens when you get rid of the debt seems to be a course not so clearly charted though. Maybe its because you’re not supposed to. Maybe you’re supposed to spend that first decade of adulthood buying things that, combined with the things you’re supposed to keep re-buying for the rest of your life, you’ll spend the whole of your existence paying for. Cars don’t last longer than the loan or lease. TVs are always available in larger, higher resolution sizes. Computers become obsolete the day after you buy them. Houses… well, don’t get me started on cabin fever.

So the fact that there’s no clear pattern for what you do when you’re debt free, making a decent income, and have no clear call (or release) to the missions field… well, maybe you can understand how that might be a source of consternation for a Christian family seeking to do what’s right in a day and age where the middle class seems to be an endangered species.

Of course a bigger house might make some sense, given what’s going on in our lives, and in the lives of those we might wish to share our home with from time-to-time. Of course we can continue to push our faith in giving to ministry. Of course we could consider buying more things we might like or temporarily enjoy, or going on the occasional family vacation. But these options range from stupid to seemingly impact-less. What if we’re plainly aware that we don’t need more things? What if we’re really bad at taking vacations? What if we’re increasingly conscious that just writing a cheque isn’t satisfying our desire to give back to God?

I don’t say any of this to brag, but if that’s how it comes across, so be it. I’m more than a little frustrated that there’s no clear instruction on what we’re supposed to do with surplus income. This is the first time in our lives we’ve legitimately had more than we need – and more than we can, in good conscience, give away. And if God doesn’t have a plan for it, and we don’t need it or even particularly want it, what is it we’re supposed to do next?

You’re blessed. Save it for a rainy day!

You ARE blessed, and pretty financially savvy to be looking at “surplus” income at your age. I am sure you will plot out a reasonable course. What we did was to plow as much money back into our mortgage as we could, uping the monthly payments by reducing the amortization as much as possible. Another option is to pay the ten percent you are allowed on an annual basis to reduce the mortgage amount and therefore maximizing your monthly payments toward reducing the capital debt. A property is an asset. Think of increasing your share of that asset and reducing the bank’s share as a way of increasing its value to you.

Another option, depending on how much surplus you have, is to buy rental properties. By doing this you can continue to “invest” in both property and in people. One option may be to buy houses that need a bit of work, fixing them up and then selling or renting them. You would be doing a service to the community by improving the properties and neighborhoods, while also protecting your investments and providing additional capital that is available if you need it in retirement.

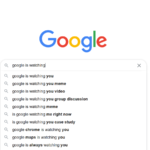

One thing I forgot to mention in previous post… College. You’re kids are going to be ready for it before you know it, and their special status gives them a lot of opportunity and choices on where to do their studies. Better start saving/investing early to meet those needs.

Yeah we did that too, as soon as we got back from Bangladesh. We couldn’t afford it then, but it sure did come in handy when the three kids went off to college and university. Basically we would not have been able to help unless we had bitten the bullet back when they were 6,5 and 3.

We lived in the houses I renovated, moving the kids from room to room as soon as we got one area done. Not easy on anyone at the time, but hugely important in gaining financial stability at our age now.