Its our goal, before we turn 31, to have zero debt (aside from our mortgage), 3 months salary in the bank, an actively growing retirement savings fund, about 10% of our mortgage paid off, and disposable monthly income we can use for our adventures.

Its our goal, before we turn 31, to have zero debt (aside from our mortgage), 3 months salary in the bank, an actively growing retirement savings fund, about 10% of our mortgage paid off, and disposable monthly income we can use for our adventures.

This year, after a few long years of hard work, catapults us forward drastically in reaching those goals. Our combined student debt will be paid off by May, and assuming all continues to go well with tax season (in two countries), my credit card debt will be gone — never to return, if we have anything to say about it.

So with those victories on the horizon, I’m feeling confident enough to write a blog post about the steps we’ve taken to reach those goals. We’re still learning about finances, so maybe some of you can add some ideas or suggestions. Or maybe some of what we’ve learned can be useful to someone out there!

Marry an Accountant

OK, maybe not everyone can do that, but seriously, its good if you (or one of you in a relationship) has a gift for, or can teach themselves the gift of, managing money.

Use Quicken

Or Microsoft Money, or Mint, or whatever product you like. The key is to have a system in place that can give you reports of where your money is going. This is critical. Developing the discipline to record your spending has an immediate benefit: you’re forced to re-visit your stupid purchases as you enter them in, and the chagrin you feel discourages you from spending like that in the future. Downloading your transaction history from your bank website is not the same as typing it in (using receipts, when possible.) This also has a long-term benefit for the next step.

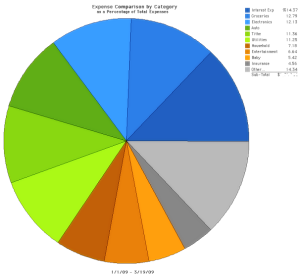

Reports like these make it clear how your expenditures break down. Once you have a couple months of data in there, you can get a very realistic picture of how you spend money, and identify areas where you might need to cut back, or become more disciplined.

Budget

This step comes after Quicken. To think you can make a realistic budget without knowing where your money is going is folly. The easiest way to become disillusioned with budgeting is to set goals you can’t really keep — in a couple weeks you’ll realise your budget it useless and throw it out.

Use Quicken (or a similar program) first, to understand what you actually spend, then set achievable goals based on those figures.

Nicole uses an in-depth, complex Excel spreadsheet where she can predict 10-12 months in advance what our financial situation will look like, based on the budgeting figures she has entered there. There’s no way we could have pulled off two international moves without the crystal ball she built in Excel.

Use Cash

You probably don’t need to do this your whole life (although we have wealthy friends who do) but at least until you can make and stick to your budget, its a great help in developing that discipline:

Every pay period, Nic takes out cash according to the budget. Then she puts it into buckets: groceries, entertainment, allowance for Jon, etc… And that’s all we spend in those categories. When the cash is gone, that’s it. The bank account is used to pay bills, and the credit cards aren’t used at all.

Tithe

When you trust God with a portion of what He gives you, He will bless you for it. That’s a guarantee. Every significant financial event in our lives, whether its a good tax season, or a raise at work, can be tied directly to obedience in this area. Also, it makes for a really great tax return. A couple practices we’ve adopted:

Don’t tithe on debt. Student loans or consolidation loans aren’t income. They’re debt, and God hates debt. That money is poison in the long term, just pay it off as soon as you’re making real money.

Do tithe on income, even when you’re in debt. If you wait until your debt is gone before you begin tithing, you may be waiting for your whole life. Set aside the tithe and the debt reduction payments first, then budget your life. God will honor your obedience and stewardship.

(Combining these two principles means if you’re a student living solely off student loans, its not the time to develop this discipline. However, if you work during the summer, tithe during the summer.)

Tithe where you’re passionate. Churches love to teach about tithing. And that’s great — its a Biblical truth. Bring your blessing to the storehouse! But that’s not the only place to tithe. We carve out a percentage of our tithe for our church, but the majority of it goes to missionaries. We’re passionate about missions, and our friends who are on the missions field. Tithing to God’s work through them is exciting, and gives us a way to be a part of that effort.

If you’re passionate about some other Godly ministry, tithe there! That doesn’t mean you can tithe to Starbucks or Best Buy (or even United Way, sorry!) Your God-portion should go to God‘s work. But there are lots of expressions of that work. Find one you can get excited about, and be obedient there!

And look for opportunities to tithe above-and-beyond. Doing so unlocks blessing above-and-beyond what you’d expect!

Let the Government Help You

Set up your taxes to err on the side of caution. Its better that they take too much from you on each pay check and owe you money at tax time, then the other way around.

Let Your Employer (or Bank) Help You

The only reason we have retirement savings is because my employer takes a little chunk off each pay check, partially matches my investment, and tucks it away into a savings program. Since we never really “see” that money, its not painful when it goes away, and before long there’s a nice, growing balance in that fund.

If your employer doesn’t have such a program, your bank can probably help you there (although I doubt they’ll match your investment.)

Either way, if you’re done college/university, start saving!

Other Stuff

Don’t buy designer clothes, or name brand food (unless the no-name equivalent is really bad). Guys, don’t be metro. I tried living like that for a while — my wife didn’t think I was any hotter, but we were a heck of a lot poorer. Be a man — a daily shower, some deodorant, and comfy old jeans will do just fine 99% of the time, and your bank account will look a lot sexier.

Don’t make major purchases without discussing them with someone first. One friend we know has her credit cards frozen in a baggie of water in her freezer. If she wants to buy something, she has to wait for the baggie to thaw before she can buy it — which gives her time to cool down and think about her purchase.

Don’t drive the nicest car of anyone you know. I know having a nice car feels really good, and man there are times when I wish we had cool features (like cruise control!) But I’d rather be a debt-free, cheerful giver, then rollin like a pimp.

Don’t “treat” yourself — except if its something you can afford out of your allowance (see budgeting, above.) No, you don’t really deserve it. If you did, someone else would see that and buy it for you! Live below your means, its better for you!

Buy a house as soon as you can afford it. Ya, I know we resisted this for a long time, but it really, really is a good investment. Our mortgage payments are less than we were paying in rent a year ago — and this place is ours!

Cut back on cable TV, cell phones, and other monthly expenses you probably don’t need as much as you think you do.

That’s about all I can think of. Nic could probably come up with more, but while she’s the family accountant, I’m the family scribe, so this is all I’ve got. Anyone else have any suggestions for how to achieve financial freedom? (Other than CutCo…?)